In the first quarter of 2024, Contemporary Amperex Technology Co. Limited (CATL) disclosed a revenue of 79.71 billion yuan, marking a 10.41% decrease from the previous year—the first decline in fourteen quarters.

China Electric Vehicles (EV) Market

On December 28, 2018, the PRC State Administration for Market Regulation and the PRC National Standardization Administration jointly issued the Electric Vehicle Energy Consumption Standards, effective on July 1, 2019, to regulate electric vehicles regarding their energy efficiency.

In certain cities in China, municipal governments impose quotas and lottery or bidding systems to limit the number of license plates issued to ICE vehicles, but exempt NEVs from these restrictions to incentivize the development of the NEV market.

Nevertheless, in January 2018, the Beijing municipal government announced that it would only allow BEVs to be considered the NEVs exempt from the license plate restrictions, and EREVs would be treated as ICE vehicles in Beijing for the purposes of obtaining license plates.

On December 10, 2018, the National Development and Reform Commission, or the NDRC, promulgated the Provisions on Administration of Investment in Automotive Industry, effective on January 10, 2019, which categorize EREVs as electric vehicles, although its impact on the Beijing municipal government's license plate policy remained uncertain.

China is both the largest passenger vehicle market and the largest NEV market in the world as measured by sales volume. China's NEV market is currently skewed towards BEVs, as 81.3% of the NEVs sold in China in 2019 were BEVs, according to the CIC Report.

As of December 31, 2019, fewer than 25% of families in first-tier cities in China had parking space suitable for installing home charging stalls, compared with over 70% of families in the United States, according to the CIC Report.

As a result, a substantial number of BEV owners in China have to rely on public charging infrastructure. As of December 31, 2019, the ratio of NEV parc to public fast charging stalls was 17.7 to 1, according to the CIC Report. This demonstrates the insufficient number of public fast charging stalls in China to support the growth of BEVs.

In April 2020, the PRC Ministry of Finance and other national regulatory authorities issued a circular to extend the original end date of subsidies for NEV purchasers to the end of 2022 and reduce the amount of subsidies in 10% increments each year commencing from 2020.

However, only NEVs with an MSRP of RMB300,000 or less before subsidies are eligible for such subsidies starting from July 2020

NIO EV integrates OpenAI through Microsoft Azure partnership

In an innovative push to enhance driver experience, NIO, a frontrunner in the electric vehicle (EV) market, is integrating generative AI technology into its automotive assistant, NOMI, utilizing Microsoft Azure’s OpenAI services. This integration marks a significant step in evolving in-car intelligence, setting a new standard for AI applications in the automotive industry.

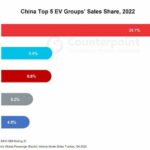

China’s EV Market Booms, with BYD Leading Outperformance

China’s passenger electric vehicle (EV) market continues to grow at an impressive rate, with EV sales rising by 87% YoY in 2022, according to the latest research from Counterpoint.

Baidu got permits for fully driverless robotaxi services in Chongqing and Wuhan

Baidu announced on 8 August 2022 that it has secured the first permits in China to offer commercial fully driverless robotaxi services to the public on open roads.

Chinese e-scooter maker NIU sales volume up 52% in 2021

Niu Technologies (“Niu”) revenues were RMB 986.1 million in Q4 2021, an increase of 46.7% year over year, according to its financial results.

Nio vehicle delivery more than double in Q3 2021

Deliveries of vehicles were 24,439 in Q3 2021, including 5,418 ES8s, 11,271 ES6s and 7,750 EC6s, representing an increase of 100.2% from Q3 2020 and an increase of 11.6% from Q2 2021.

China’s Gen-Z a driving force for the next decade’s automobile growth

China’s automotive market would boom in the third to fourth-tier cities over the next ten years, with those born after 1995 being the dominant force of car buyers, according to the JD Big Data Research Institute’s report on Gen-Z, released in August 2021. Apart from the vast incremental market opportunities, the report also stated that […]

Profile of Didi, China’s ride-hailing giant

Didi is the world’s largest mobility technology platform. It has been strategically building four key components of its platform that work together to improve the consumer experience: shared mobility, auto solutions, electric mobility, and autonomous driving. Didi (company name Xiaoju Kuaizhi Inc) started its mobility business in China in 2012. It has become the world’s […]

Li Auto vehicle deliveries up 111% in April 2021

Li Auto delivered 5,539 Li ONEs in April 2021, representing a 111.3% year-over-year increase and taking the cumulative deliveries to 51,715.

Forecast of China’s digital automobile and transportation market 2021-2025

The digital automobile and transportation market is considered to be the entire ecosystem of companies, products, and services related to automobiles and transportation infrastructure based on the Internet, IoT, and third-party platform technologies. The digital automobile and transportation ecosystem includes a wide range of market participants, including but not limited to: automobile manufacturers, suppliers and […]

China’s automobile sales expected to reach 25 million units in 2020

In November this year, China’s domestic automobile production and sales volume were 2.847 million and 2.77 million respectively, with a month on month increase of 11.5% and 7.6%, and year-on-year growth of 9.6% and 12.6% respectively.

SAIC Volkswagenn, Nio lead in New Energy Vehicle Quality in China

SAIC Volkswagen ranks highest in NEV new-vehicle quality among all brands in the PHEV segment in China, followed by BMW, while NIO ranks highest among all brands in the BEV segment, followed by Tesla, according to a JD Power report. As the New Energy Vehicle (NEV) market in China gets in the fast lane, the […]

Chinese EV maker XPeng eyes for $1.11 bn IPO in the US

Chinese electric vehicle (EV) manufacturer XPeng hopes to raise up to $1.11 billion in its IPO in New York. It said on 21 August 2020 it intends to sell 85 million shares American depositary share (ADS), each representing two class A ordinary share, priced between $11 and $13 per share.

An overview of China EV market

While electric vehicles only accounted for 2.6% of global car sales last year, this is an all-time high for the industry. It’s been growing steadily at a rate of about 40% each year, so don’t count the EV market as a lost cause yet! China EV Industry Overview Since electric vehicles made their way on to the […]

Meituan-bakced EV Li Auto to raise US$950M in US IPO

Meituan-bakced EV Li Auto aims to raise US$950 million in its initial public offering of 95,000,000 American depositary shares, or ADSs. Li Auto anticipates that the IPO price per ADS will be between US$8.00 and US$10.00.